2021-09-22

Announcement Regarding Launch of “Money Forward Business Card” a Prepaid Card for Businesses that Supports Payments of Up to 50 Million Yen

Postpaid Function Using “Money Forward Cloud” Data Will be Also Provided

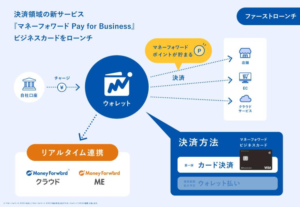

Money Forward, Inc. (Head office: Minato-ku, Tokyo; Representative Director, President and CEO: Yosuke Tsuji; “Money Forward”) today announced the launch of “Money Forward Pay for Business” service to promote business efficiency and cashless operations through a variety of payment methods, and will offer the “Money Forward Business Card,” a corporate prepaid card for sole proprietors and corporations that allows payments of up to 50 million yen*1 per transaction.

Through the Card, Money Forward will realize a cashless system for business-related payments, as well as improve the efficiency of accounting operations by acquiring data on a real-time basis through integration with “Money Forward Cloud “*2.

The card is a prepaid card*3 for business use that can be used to purchase products and make payments. Since the card can be issued without a credit application, it can be used immediately. Therefore, even companies in the early stages of business can settle large amounts of server fees and other expenses by this card. In addition, we offer a closed beta version of the “Postpaid Function” that does not require pre-charging and provides a maximum monthly usage limit of several hundred million yen based on our unique credit analysis model.

Furthermore, since the number of real and virtual cards*4 that can be issued per corporation is limitless, it is possible to distribute a card to each employee for use in payment of expenses, and to prevent unauthorized use by setting the maximum settlement amount for each card (card control function). In addition, 1 to 3%*5 of the settlement amount is returned as “Money Forward Points” (equivalent to 1 yen per point), which helps to reduce the cost burden.

As part of the release campaign, 3,000 Money Forward Points will be given to customers who newly apply for the card and complete the first card issuance process by December 31, 2021.

*1 Settlement of up to 50 million yen per transaction is possible only for payments (e.g., cloud system usage fees, etc.) at specific merchants that have been registered based on pre-screening. The default setting is 1,000,000 yen, which can be changed to 5,000,000 yen by changing the setting by users.

*2 This refers to “Money Forward Cloud Accounting”, “Money Forward Cloud Tax Return”, and “Money Forward Cloud Expense”.

*3 Prepaid card is a card that can be used to purchase products and make payments after being charged with money in advance.

*4 Virtual card is a card that uses only the information necessary for settlement, such as the card number and expiration date, without issuing a plastic card. A predetermined fee will be charged for the issuance of additional real cards.

*5 Normally, 1% of the settlement amount will be returned as points (some cases may not be eligible), and 3% of the settlement amount will be returned as points for “Money Forward Cloud” and “Money Forward ME”.

■ About “Money Forward Pay for Business”

“Money Forward Pay for Business” is a cashless platform that promotes cashless transactions through a variety of payment methods such as book cards and wallet payments, thereby improving the efficiency of back-office operations. In addition, Money Forward plans to conduct its own credit screening through data linkage with “Money Forward Cloud.”

As a first step, Money Forward will provide “Money Forward Business Card” which allows card payment from pre-paid wallet balance. In the future, Money Forward will continue to develop further services such as expanding wallet functions enabling direct payment from the wallet without the need for a card, and QR Code payment.

■ Features of “Money Forward Business Card”

・Streamline companies’ accounting operations by acquiring transaction data in real time through integration with “Money Forward Cloud”

・1 to 3% of the settlement amount is returned as “Money Forward Points” which can be used for settlements at 1 yen per point.

・No monthly limit to the amount of money that can be spent, and each transaction can be up to 50 million yen.

・No monthly spending limit, up to 50 million yen per transaction

・ny number of real and virtual cards can be issued (exceptions apply)

・Card control function allows companies to customize settlement limits for each card

・Plans to offer a “Postpaid Function” that does not require pre-charging, based on an original credit analysis model

URL:https://biz.moneyforward.com/biz-pay/

URL:https://biz.moneyforward.com/expense/biz-pay/ (For more than 30 employees)

■ About “Money Forward Business Card”

Card issuing entity: Money Forward, Inc.

Name: Money Forward Business Card

Annual fee: Free

Partner brand: Visa

Partner: Infcurion, Inc.

Orient Corporation (Orico Card)

GMO Aozora Net Bank, Ltd.

■ Linkage with “Money Forward Cloud”

The function of linking with “Money Forward Cloud” is to link the settlement data of “Money Forward Business Card” to “Money Forward Cloud” as accounting journal data and replacement expense reimbursement data. By linking data such as payees, dates, and amounts, it not only greatly reduces manual entry and journal work, but also enables speedy monthly closing and expense processing by linking transaction data more quickly and in real time than general business cards.

■ About “Postpaid Function”

Currently, Money Forward is offering a closed beta version of the “Postpaid Function” that enables payment without the need for a pre-charge (to be officially released this winter). This function is based on the accounting data in “Money Forward Cloud” as well as the balance and deposit / withdrawal history of the linked bank account*6. Depending on the results of the screening process, it may be possible to set a higher credit limit compared to a conventional corporate card.

*6 Account information and other information will be used based on the consent of the individual business owner or corporation.

■ Background

While there is a growing demand for corporate credit cards among sole proprietors and small and medium-sized companies, users of conventional corporate cards faces issues such as the difficulty in passing the initial credit check, and the low spending limit. In addition, it takes time to obtain transaction details, which leads to delays in monthly closing as well as the fact that many employees still use cash or their personal credit cards for reimbursement of their expenses, and the reimbursement process is time-consuming. Even in the case of distributing company-named cards that can be directly deducted from the company’s bank account to employees, the number of cards is limited, and sharing cards among multiple employees makes it difficult to keep track of the usage history, and the inability to set a maximum limit per card can lead to fraudulent use.

In order to solve these issues, Money Forward would like to provide cards that offers credit based on its own screening, that can obtain transaction data in real time, eliminate the card issuance limit, and have card control functions.

■ About Money Forward Inc.

Name: Money Forward, Inc.

Location: 21F Tamachi Station Tower S, 3-1-21 Shibaura, Minato-ku, Tokyo 108-0023

Representative: Yosuke Tsuji, Representative Director, President and CEO

Establishment: May 2012

Overview: Leading Fintech/SaaS company in Japan / Listed in 1st Section of Tokyo Stock Exchange

URL: https://corp.moneyforward.com/en

Main Services:

“Money Forward Cloud”, SaaS platform for back-office operation https://biz.moneyforward.com/

“Money Forward ME”, a service to visualize personal finance https://moneyforward.com/

*All company names and product/service names (including logos) are trademarks or registered trademarks of their respective owners.