Society Forward

We believe creating a better society is essential for achieving our Mission. We will strive to realize “Society Forward” by contributing to DX of society through co-creation with a wide range of partners, activities to realize better social systems, and implementation of eco-friendly management.

Contribute to DX of Society with Diverse Partners

Our Approach

In recent years, rapid change in business environment has accelerated the digital transformation (DX) initiatives to enhance corporate competitiveness and improve productivity. Our business is promoted with a wide range of partners including financial institutions, accounting firms, corporations and chambers of commerce and industry across Japan. We aim to continue our contribution to DX of society by building a solid ecosystem with diverse partners. Through these initiatives, we will contribute to the achievement of SDGs Goals 8, 12, and 17.

Key Initiatives

Promotion of DX with a wide range of business partners including financial institutions, accounting firms, corporations and chambers of commerce and industry across Japan

Promoting Activities to Realize a Better Social System

Our Approach

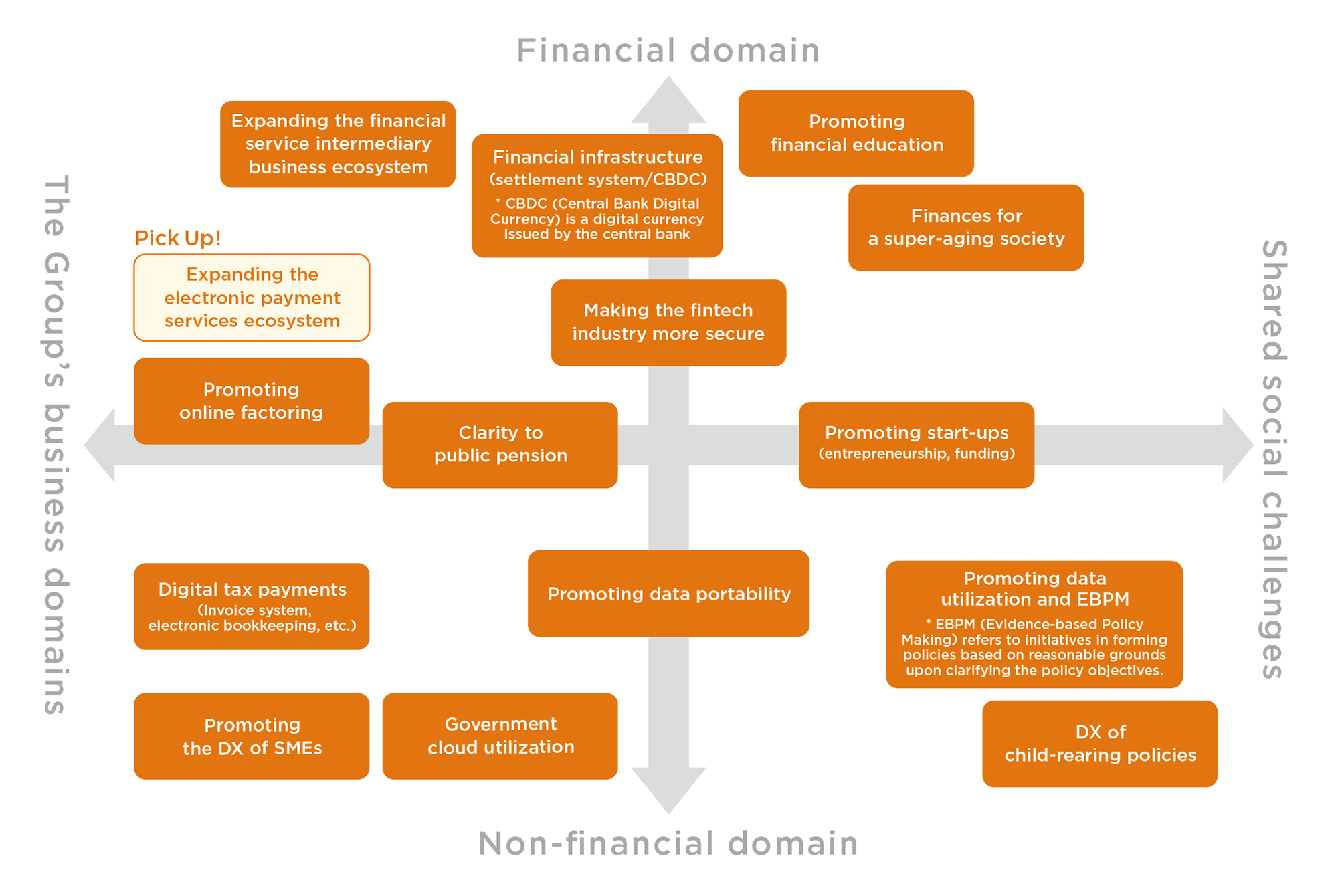

Money Forward Group is spearheading institutional reforms through wide-ranging activities, including proposing policies at meetings hosted by the government, conducting research at Money Forward Lab, and sharing our initiatives via our services. We are also aiming to cultivate an ecosystem for achieving financial innovation by organizing industry groups, including the Fintech Association of Japan and Japan Association for Financial APIs. Furthermore, we are creating opportunities for individuals across all generations to think about their finances by holding educational classes and events and operating user communities.

Through these initiatives, we will contribute to the achievement of SDGs Goals 4, 10, and 17.

Key Initiatives

- *1

- CBDC (Central Bank Digital Currency) is a digital currency issued by the central bank.

- *2

- EBPM (Evidence-based Policy Making) refers to initiatives in forming policies based on reasonable grounds upon clarifying the policy objectives.

<Initiatives in the Past>

- ・Money Forward Starting from Age 18, a project aimed at improving financial literacy

- ・Money School targeting nurseries

- ・Kids Money Program by Money Forward

- ・Joint development and hosting of events using Money Quest, a card game for learning about money

- ・Money Forward × SOZOW Online “money” activity for kids and their parents

- ・Money program for active athletes

- ・Financial online event for new adults

- ・Financial education project ‘Katariba Online for Teens with Money Forward‘ in collaboration with NPO Sailor

- ・Conducted a lecture at Nagasaki Prefectural Kibogaoka High School for special support school

- ・“Easy Checklist for Financial Preparedness for Disasters” Released

- ・“MoneyForward Business Card” Sponsor Points Can Be Donated to Social Contribution Organizations and Sports Organizations

- * Links above are only available in Japanese.

- ・Donations to non-profit organizations (school corporations and NPOs), etc. (FY2024: 1.11 million yen)

Practice Environmentally Friendly Management

Our Approach

Money Forward Group is working on reducing the movement of people and the use of paper resources by introducing remote work and shifting to cloud-based business operations including for internal memorandum, settlement of expenses, and contracting.

We believe that we can achieve more eco-friendly society with paperless back office operation. We will continue to implement environment friendly management by further promoting the reduction of movement of people and the use of paper through business growth and review of internal operations.

Through these initiatives, we will contribute to the achievement of SDGs Goal 15.

Key Initiatives

- Internal Initiatives

- ・Introduction of a new workstyle centered on remote work Reduction in the movement of people and goods, and the use of paper by shifting to cloud-based operations including for internal memorandum, settlement of expenses, and contracting

- ・Utilization of FIT non-fossil certificates with tracking for electricity in all offices across Japan.

- ・Active Utilization of Data Centers Powered by Renewable Energy

- Service-based Initiatives

- ・Improving operational efficiency and promoting reduction of paper usage including for invoices by migrating back-office operations to cloud

- ・Efforts to visualize environmental impact utilizing fintech (Patented)

Money Forward Group are working to reduce Greenhouse gas emissions.

Our Group’s greenhouse gas emissions (FY2024)

- Scope 1(Direct emissions from fuel use, etc.)

- 0(t-CO2)

- Scope 2(Indirect emissions from purchased electricity use)*1

- 327(t-CO2)

- Scope 3(Other indirect emissions)

- Category 1(Emissions associated with the use of data centers for purchased goods and services.)37(t-CO2)Category 7(Employee commuting)254(t-CO2)

- *1

- Calculated on a location basis. The Tokai Branch Office has been using 100% renewable energy electricity and all other domestic offices switch to 100% renewable energy using FIT non-fossil certificates with tracking to reduce environmental impact.

- *2

- Phased disclosure starting in FY2023. Reduction of environmental impact through the use of data centers that use renewable energy.