Sustainability of Money Forward Group

Since our founding, we have embraced our corporate mission, “Money Forward. Move your life forward,” and aspired to eliminate financial issues and concerns from the world. Money is merely a tool for living. Yet, many individuals and companies are pressured and affected by it due to lack of adequate knowledge and are unable to take actions. Through our services, we support people to move their lives forward and to drastically enrich everyday life, thus create a society that drives challenges.

Click here for the most recent ESG data.

CEO message

CEO’s Blog (Japanese)

Three Priority Themes (Materiality) to Achieve our Vision for the Society

To realize our vision for the society and to steadily increase shareholder value, we have organized and set three key themes of materiality: “User Forward,” “Society Forward,” and “Talent Forward. We will focus on these as well as the supporting foundations, i.e., “penetration of Money Forward’s Mission/Vision/Values/Culture” and “Governance that balances offense and defense.”

User Forward

- Provide Services that Solve Financial Issues for a Diverse Range of Users (B2B and B2C)

- Solve Users’ Problems with Technology and Design

- Promote Investment in Security to Ensure the Safety

Society Forward

- Contribute to DX of Society with Diverse Partners

- Promoting Activities to Realize a Better Social System

- Practice Environmentally Friendly Management

Talent Forward

- Foster a safe work environment and corporate culture

- Recruit talented and diverse members who align with our MVVC*

- Create a system that maximizes individual potential

- Foster autonomous personal development

- Connect individual development to organizational development

Foundations Supporting Three Priority Themes

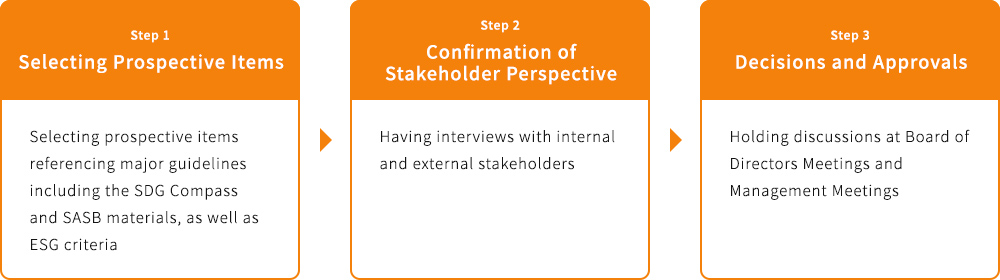

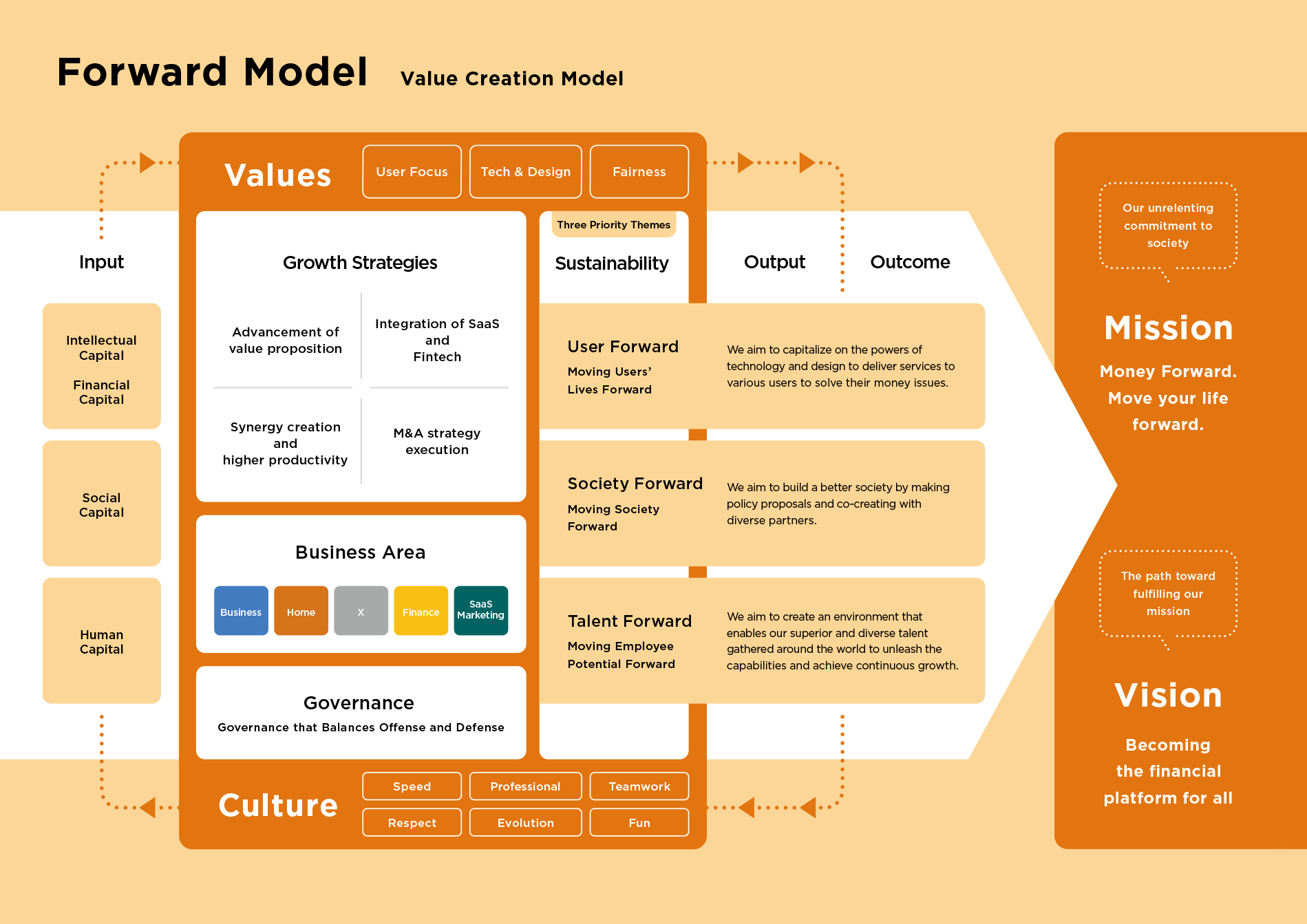

Identification of Priority Themes

Sustainability Indicators

To demonstrate our managerial commitment to the three materiality themes, we sat forth and disclose our sustainability indicators. Apart from our financial KPIs, we will closely monitor these indicators on a continual basis to measure our progress in sustainability.

| Materialities | Sustainability Indicators | FY2022 | FY2023 | FY2024 | FY2025 | |

|---|---|---|---|---|---|---|

| User Forward | Businesses | SaaS Applications for Back-Office Operations: Paying Customers*1 | 235,798 | 301,233 | 372,309 | 441,707 |

| Money Forward Cloud: Corporate Customer Churn Rate*2 | 0.8% | 0.8% | 0.8% | 0.8% | ||

| Money Forward Kakebarai and Early Payment: Cumulative Amount of Receivables*3 | ¥135.2 bn | ¥287.2 bn | ¥539.8 bn | ¥891.1 bn | ||

| Money Forward X: Partner Companies*4 | 67 | 81 | 83 | 83 | ||

| Individuals | Money Forward ME: Yearly Improvement in Personal Finance*5 | ¥281,000 | ¥295,000 | ¥301,000 | ¥291,000 | |

| Amount of Assets Managed under All Integrated Accounts*6 | ¥7.7 tn | ¥11.0 tn | ¥15.4 tn | ¥19.9 tn | ||

| Amount of Financial Assets under All Integrated Accounts*7 | ¥17.3 tn | ¥21.3 tn | ¥26.7 tn | ¥32.4 tn | ||

| Society Forward | Money Forward Cloud: Certified Members*8 | 25,258 | 32,364 | 41,010 | 51,468 |

|---|---|---|---|---|---|

| Money Forward Cloud: Chambers of Commerce in Alliance*9 | 123 | 137 | 144 | 150 | |

| Money Forward X: Services Provided*10 | 126 | 180 | 187 | 188 |

| Talent Forward | Ratio of women among managers (Overall*11/ Business Side*12) | 20.2%/26.0% | 20.4%/24.1% | 19.3%/22.1% | 20.1%/24.9% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cumulative Number of Participants in Leadership Forward Program*13 | 126 | 179 | 304 | 419 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Cumulative Number of Participants in Manager Basic Training*14 | 419 | 591 | 1,108 | 1,608 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Acquisition rate of childcare leave*15(women/men) | 100.0%/50.0% | 92.9%/87.1% | 91.4%/73.9% | 91.1%/85.4% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Employee Engagement (MF Group Survey)*16

| ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

- * 1 The total number of businesses (corporates and sole proprietors) that pay a subscription fee for Money Forward Cloud or other SaaS applications for back-office operations.

- * 2 The average monthly churn rate for “Money Forward Cloud” for each fiscal year.

- * 3 The cumulative transaction amount processed through “Money Forward Kakebarai” and “Money Forward Fast Receivables (including Early Payment, Transaction Finance for Startups, and SHIKIN+).

- * 4 The number of companies that have entered into a business alliance in X segment.

- * 5 12 times the average of the monthly amount of improvement in personal finances as perceived by users who responded that they felt their personal finances have improved, according to a survey targeting Money Forward ME users.

- * 6 The total amount of assets being managed under all individual users’ accounts linked to Money Forward ME and services for financial institutions provided in X segment. Assets under management include listed stocks (spot-trading), bonds, mutual funds, and defined contribution pensions.

- * 7 The total amount of financial assets under all individual users’ accounts linked to Money Forward ME and services for financial institutions provided in X segment.

- * 8 The number of users who have a Money Forward ID among the certified members of Money Forward Cloud.

- * 9 The total number of chambers of commerce that have entered into an alliance with Money Forward Cloud.

- *10 The total number of services provided in X segment.

- *11 The ratio of women among Money Forward Group’s regular employees in managerial positions.

- *12 The ratio of women among Money Forward Group’s regular employees in business-side (i.e., other than engineering and design) managerial positions.

- *13 The total number of participants of a training program for fostering next-generation leaders targeting Money Forward Group’s regular employees.

- *14 The total number of participants of a training program targeting Money Forward Group’s regular employees in managerial positions.

- *15 Starting from FY2023, the childcare leave utilization rate is calculated in accordance with Article 71-6(1)(i) of the Ordinance for Enforcement of the Act on Childcare Leave, etc., as required for human capital disclosure.

Specifically, the rate is the ratio of the number of men who took one or more days of new postnatal parental leave or childcare leave during each fiscal year divided by the number of men whose spouses gave birth, and the same for women, divided by the number of women who took new childcare leave.

For FY2022, the calculation is based on the number of employees whose children were born between April 2021 and March 2022 and who took childcare leave by August 31, 2022, as aggregated by Money Forward based on applications for child birth celebration money. - *16 The average score of key items considered indicators of employee engagement, taken from a survey conducted among full-time and contract employees of the Money Forward Group (as of August 31, 2024). The survey uses a five-point scale, with 5 being the highest rating.

- *17 New addition following the announcement of the “Talent Forward Strategy 2024”

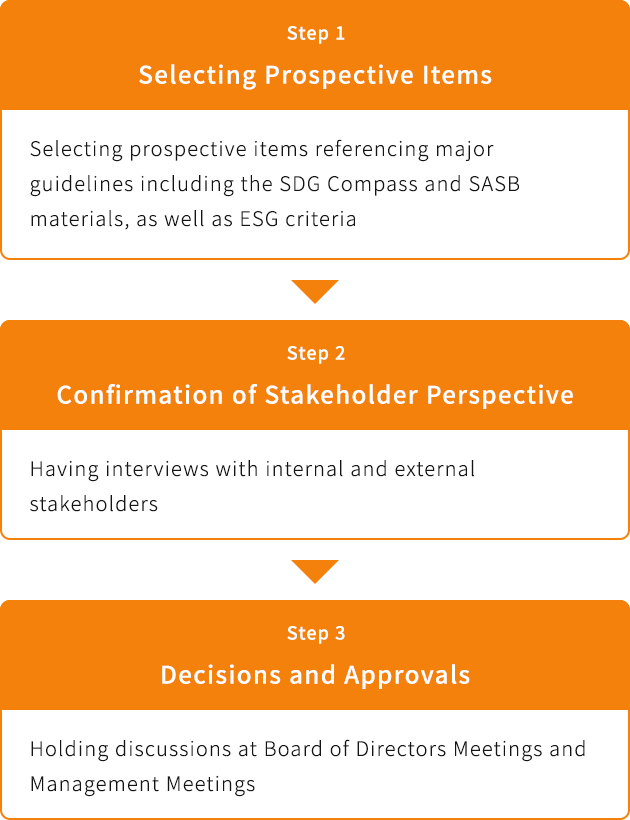

Value Creation Model

Structure for Promoting Sustainability

In February 2021, we appointed Toshio Taki, Executive Officer and Group CoPA (Chief of Public Affairs), as Head of Sustainability.

We also established the Sustainability Committee with the aim of further promoting sustainability through regular discussions including External Directors and Executive Officers of each business division in February 2022. The Committee is composed of members appointed by the Board of Directors, and is chaired by the Representative Director, President and Group CEO. The Committee also ensures the effectiveness and efficiency of sustainability measures by requesting the attendance of External Directors and senior executives of each business division as necessary.

The Committee meets to deliberate on sustainability initiatives as necessary, to deliberate on sustainability initiatives, monitor the implementation of the measures, and report to the Board of Directors.

Members of the Committee’s Office will further promote company-wide efforts to implement various measures determined by the Committee and the Board of Directors, through coordination with liaisons in related corporate and business divisions within the Group.

In February 2023, we have established a Compliance and Risk Management Committee (renamed the Group Risk Management Committee as of December 1, 2024) and are collaborating with our existing Sustainability Committee to establish a system for addressing climate change. In addition, as part of our risk management efforts, we have identified the risks and opportunities that climate change presents to our business activities and are implementing disclosures based on the TCFD framework.

Click here for the disclosure based on the TCFD.

Acknowledgment as a Sustainable Company

Money Forward Receives AA in the MSCI ESG Rating

Money Forward has received “AA” in the MSCI ESG Rating

THE USE BY MONEY FORWARD OF ANY MSCI ESG RESEARCH LLC OR ITS AFFILIATES (“MSCI”) DATA, AND THE USE OF MSCI LOGOS, TRADEMARKS, SERVICE MARKS OR INDEX NAMES HEREIN, DO NOT CONSTITUTE A SPONSORSHIP, ENDORSEMENT, RECOMMENDATION, OR PROMOTION OF MONEY FORWARD BY MSCI. MSCI SERVICES AND DATA ARE THE PROPERTY OF MSCI OR ITS INFORMATION PROVIDERS, AND ARE PROVIDED ‘AS-IS’ AND WITHOUT WARRANTY. MSCI NAMES AND LOGOS ARE TRADEMARKS OR SERVICE MARKS OF MSCI.

Related link>Press Release

MSCI ESG Leaders Indexes are developed by MSCI Inc (USA) (‘MSCI’) and are global indices that select companies with outstanding ESG initiatives.

THE INCLUSION OF MONEY FORWARD IN ANY MSCI INDEX, AND THE USE OF MSCI LOGOS, TRADEMARKS, SERVICE MARKS OR INDEX NAMES HEREIN, DO NOT CONSTITUTE A SPONSORSHIP, ENDORSEMENT OR PROMOTION OF MONEY FORWARD BY MSCI OR ANY OF ITS AFFILIATES. THE MSCI INDEXES ARE THE EXCLUSIVE PROPERTY OF MSCI. MSCI AND THE MSCI INDEX NAMES AND LOGOS ARE TRADEMARKS OR SERVICE MARKS OF MSCI OR ITS AFFILIATES.

Related link>MSCI ESG Leaders Indexes (external website)

MSCI ESG Select Leaders Nihonkabu Index is constructed by selecting companies that excel in ESG assessment from among the constituents of the parent index (MSCI Japan Equity IMI Index), according to each industry category.

THE INCLUSION OF MONEY FORWARD IN ANY MSCI INDEX, AND THE USE OF MSCI LOGOS, TRADEMARKS, SERVICE MARKS OR INDEX NAMES HEREIN, DO NOT CONSTITUTE A SPONSORSHIP, ENDORSEMENT OR PROMOTION OF MONEY FORWARD BY MSCI OR ANY OF ITS AFFILIATES. THE MSCI INDEXES ARE THE EXCLUSIVE PROPERTY OF MSCI. MSCI AND THE MSCI INDEX NAMES AND LOGOS ARE TRADEMARKS OR SERVICE MARKS OF MSCI OR ITS AFFILIATES.

Related link>ESG-SelectLeaders-Nihonkabu (external website)

MSCI Japan ESG Select Leaders Index

Money Forward is selected as a constituent of the MSCI Japan ESG Select Leaders Index, a leading index of environmental, social and governance (ESG) investment. The index is adopted by Japan’s Government Pension Investment Fund (GPIF), as references for making its investments.

THE INCLUSION OF MONEY FORWARD IN ANY MSCI INDEX, AND THE USE OF MSCI LOGOS, TRADEMARKS, SERVICE MARKS OR INDEX NAMES HEREIN, DO NOT CONSTITUTE A SPONSORSHIP, ENDORSEMENT OR PROMOTION OF MONEY FORWARD BY MSCI OR ANY OF ITS AFFILIATES. THE MSCI INDEXES ARE THE EXCLUSIVE PROPERTY OF MSCI. MSCI AND THE MSCI INDEX NAMES AND LOGOS ARE TRADEMARKS OR SERVICE MARKS OF MSCI OR ITS AFFILIATES.

Related link>MSCI Japan ESG Select Leaders Index (external website)

MSCI Japan Empowering Women Index (WIN)

Money Forward is included in the MSCI Japan Empowering Women Index (WIN) for companies with exceptional gender diversity. This inclusion indicates that Z Holdings Corporation has been assessed as a company leading efforts to support the participation and promotion of women in the workplace through diversity policies. The index is adopted by Japan’s Government Pension Investment Fund (GPIF), as references for making its investments.

THE INCLUSION OF MONEY FORWARD IN ANY MSCI INDEX, AND THE USE OF MSCI LOGOS, TRADEMARKS, SERVICE MARKS OR INDEX NAMES HEREIN, DO NOT CONSTITUTE A SPONSORSHIP, ENDORSEMENT OR PROMOTION OF MONEY FORWARD BY MSCI OR ANY OF ITS AFFILIATES. THE MSCI INDEXES ARE THE EXCLUSIVE PROPERTY OF MSCI. MSCI AND THE MSCI INDEX NAMES AND LOGOS ARE TRADEMARKS OR SERVICE MARKS OF MSCI OR ITS AFFILIATES.

Related link>MSCI Japan Empowering Women Index (WIN) (external website)

FTSE4Good Index Series

The FTSE4Good Index Series is one of the globally recognized ESG investment indices developed by FTSE Russell, a leading ESG rating agency. It includes companies that meet internationally high standards in environmental, social, and governance (ESG) practices, and is widely used as a benchmark by global investors.

FTSE JPX Blossom Japan Index

“The FTSE JPX Blossom Japan” Index is an ESG investment index developed by FTSE Russell, a leading ESG rating agency. It includes selected Japanese companies that demonstrate strong ESG initiatives, based on a comprehensive evaluation of their overall ESG performance.

* FTSE Russell confirms that Money Forward Inc. has been independently assessed according to the index criteria, and has satisfied the requirements to become a constituent of the FTSE JPX Blossom Japan Index. Created by the global index and data provider FTSE Russell, the FTSE JPX Blossom Japan Index is designed to measure the performance of companies demonstrating specific Environmental, Social and Governance (ESG) practices. The FTSE JPX Blossom Japan Index is used by a wide variety of market participants to create and assess responsible investment funds and other products.

FTSE JPX Blossom Japan Sector Relative Index

“FTSE JPX Blossom Japan Sector Relative Index” is created by FTSE Russell, one of the leading ESG rating agencies, and evaluates companies that excel in ESG (Environmental, Social, and Governance) practices. Approximately 500 companies with relatively high scores are selected for inclusion.

* FTSE Russell confirms that Money Forward Inc. has been independently assessed according to the index criteria, and has satisfied the requirements to become a constituent of the FTSE JPX Blossom Japan Sector Relative Index. The FTSE JPX Blossom Japan Sector Relative Index is used by a wide variety of market participants to create and assess responsible investment funds and other products.