Initiatives Concerning Human Rights Risks

The Company has established the “Money Forward Group Human Rights Policy” as a policy to promote initiatives of respecting human rights by resolution of the Board of Directors on April 14, 2023. In order to understand the notable human rights risks and the current state of measures of the Group, as part of human rights due diligence, impact evaluations of human rights have been conducted for employees.

Please see the Money Forward Group Human Rights Policy here.

Selection of Human Rights Issues

In order to clarify tangible and potential human rights risks that may occur within the Group, the following human rights risks expected of the Group have been selected.

Human rights issues, discrimination, foreign worker rights, power harassment, sexual harassment, maternity/paternity harassment, care harassment, forced labor, child labor, excessive/long working hours, short/unpaid wages, living wages, freedom of association, safety and health, freedom of expression, privacy rights, and information management concerning gender (including sexual minorities)

Initiatives to identify and evaluate, and measures to prevent and lessen adverse impacts to notable human rights

In order to identify adverse impacts to notable human rights of employees and temporary employees of the Group, referring to guidelines concerning human rights such as the “UN Guiding Principles Reporting Framework,” evaluations of the likelihood of adverse impacts to human rights, the severity of adverse impacts, and scope of adverse impacts and difficulty of correction were conducted, focused mainly on the supervising companies and departments in charge.

The adverse impacts to notable human rights that were identified and evaluated, and the main initiatives to prevent and lessen their occurrences, are as follows.

| Content | Measures to prevent and lessen |

|---|---|

| Harassment |

|

| Discrimination |

|

| Excessive/long working hours Safety and health |

|

Other Initiatives

Training

The Group provides compliance training so that all officers and employees (regardless of whether they are new graduate hires, mid-career hires, part-time or casual employees, interns, temporary employees, or hired under other arrangements) can acquire knowledge on compliance and be more aware of compliance. In addition to touching on human rights risks during training on overall compliance and Code of Conduct, training on harassment prevention is conducted through e-learning programs (incorporating online learning material and comprehension tests).

Please see the dates and attendance rates here.

Hotlines

In order to appropriately respond to compliance violations, including human rights, the Group has established points of contact which enable the Group’s officers and employees to make anonymous reports by means such as email and chat tools, on a violation of laws or ordinances, compliance violations (including a violation of the Group Compliance Rules or other internal rules or a violation of the action guidelines provided in the Money Forward Group Compliance Manual), an act of harassment, or an act that could lead to any of such violations or harassment in the Company and Group companies.

Please see here for details.

Creating a Safe Work Environment

To realize our vision for the society and to steadily increase shareholder value, the Company has set “Talent Forward (Moving Employee Potential Forward)” as one theme of materiality. And so, the Company has organized the five key tenets of our HR philosophy into a strategy that we call the “Talent Forward Strategy.” One of the measures is to “foster a safe work environment and corporate culture,” to strive to create an environment in which employees with different backgrounds and values can feel comfortable working together and respect each other’s differences.

Please see here for specific initiatives.

For disclosure based on TCFD

In order to understand the risks, opportunities, and impacts of future climate change on our business activities, we predicted and analyzed changes in the external environment in accordance with the framework proposed by the Task Force on Climate-related Financial Disclosures (TCFD). As a result, we perceive that there are significant opportunities in our business domains, represented by the potential rise in demand for cloud services, and on the other hand the risks are relatively small. On the opportunity front, we will explore possibilities of expanding our business scope, whereas on the risk front, we will minimize exposure while assessing cost-effectiveness.

*We support TCFD, and Join TCFD Consortium Japan.

Governance

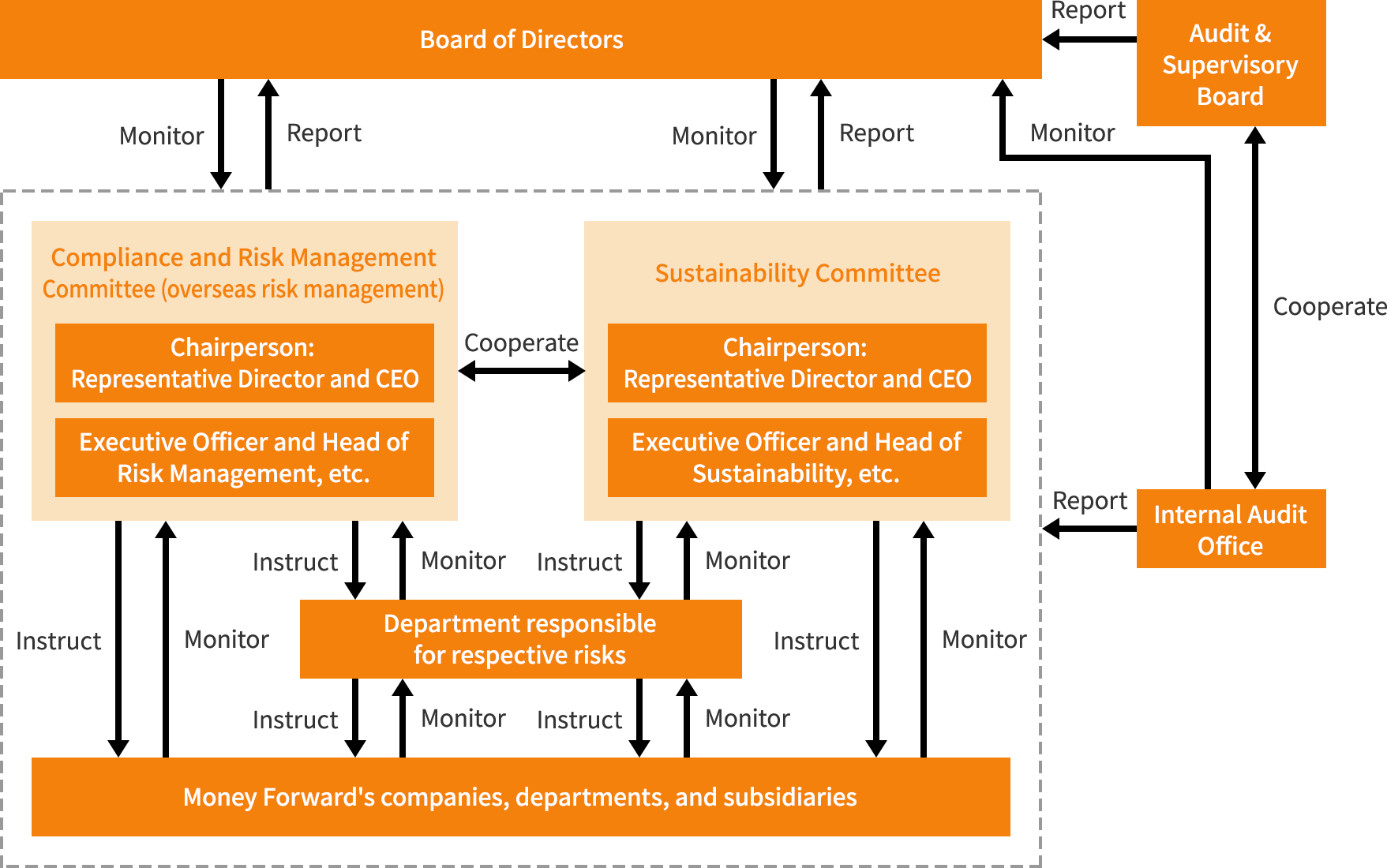

The Company has set up the Compliance and Risk Management Committee and Sustainability Committee under the Board of Directors. Both are composed of members appointed by the board, and chaired by the Representative Director,President and CEO.The Compliance and Risk Management Committee (hereinafter referred to as the “Risk Committee”) oversees risk management, instructs countermeasures to departments responsible for respective risks, and reports the situation to the Board of Directors. Meanwhile, the Sustainability Committee oversees climate change risks, instructs countermeasures to departments responsible for respective risks, and together with the Risk Committee reports the situation to the Board of Directors. The Internal Audit Office checks and supervises the overall risk management structure and status from an independent standpoint.

Strategies

We have identified the following risks and opportunities related to climate change.

| Scenario | Risk or Opportunity for the Company | Impact Level | Countermeasures | ||

|---|---|---|---|---|---|

| Transitional Risks | Policy and Regulatory Risk | Introduction of carbon tax | Increased tax burden due to carbon tax | Small | Reduce greenhouse gas (GHG) emissions |

| Market Risk | Rise in renewable energy prices | Increased cost burden for procuring renewable energy | Small | Reduce costs by diversifying and optimizing power suppliers | |

| Reputational Risk | Accelerated ESG investments | Difficulty raising funds Reputational Accelerated ESG from financial institutions investments and investors if climate change measures are evaluated as inadequate | Small | Enhance information disclosure and engage in appropriate dialogue with financial institutions and investors | |

| Physical Risks | Acute Risk | Intensification of natural disasters | Outage of data center Damages to the office and Medium employees | Medium | Strengthen business continuity plans (BCPs) (including dispersing risks of facility damages and promoting offsite measures) |

| Opportunities | Product/ Service | Accelerated DX | Increased demand for cloud services | Large | ー |

Risk Management

In order to understand and evaluate the impact of climate change on the Group’s business, we analyze scenarios and identify related risks and opportunities. Risks and opportunities that are identified are monitored by the Sustainability Committee in collaboration with the Risk Committee. There is also a process flow in which reports and recommendations are made to the Board of Directors depending on the gravity of the case.

Indicators and Goals

Money Forward Group are working to reduce Greenhouse gas emissions.

Our Group’s greenhouse gas emissions (FY2024)

- Scope 1(Direct emissions from fuel use, etc.)

- 0(t-CO2)

- Scope 2(Indirect emissions from purchased electricity use)*1

- 327(t-CO2)

- Scope 3(Other indirect emissions)

- Category 1(Emissions associated with the use of data centers for purchased goods and services.)37(t-CO2)Category 7(Employee commuting)254(t-CO2)

- *1

- Calculated on a location basis. The Tokai Branch Office has been using 100% renewable energy electricity and all other domestic offices switch to 100% renewable energy using FIT non-fossil certificates with tracking to reduce environmental impact.

- *2

- Phased disclosure starting in FY2023. Reduction of environmental impact through the use of data centers that use renewable energy.