INDEX

Basic Policy on Compliance

The Group believes compliance to be a precondition for conducting its corporate activities. For the Group, compliance extends beyond simply following laws and regulations, internal rules and any other written rules, and social norms. It requires all officers and employees to observe the Company’s Value, respond to rational expectations and demands from customers, shareholders and other stakeholders, act with sincerity and appropriately as a corporate citizen and member of society, and embody the Company’s Culture.

In addition to setting forth in the “Money Forward Group Compliance Manual” the basic compliance-related action guidelines that must be practiced by the Group’s officers and employees, the Group is committed to fostering a compliance culture within the Group and to realizing the Group where compliance can be achieved naturally by all officers and employees without special awareness of compliance in business activities.

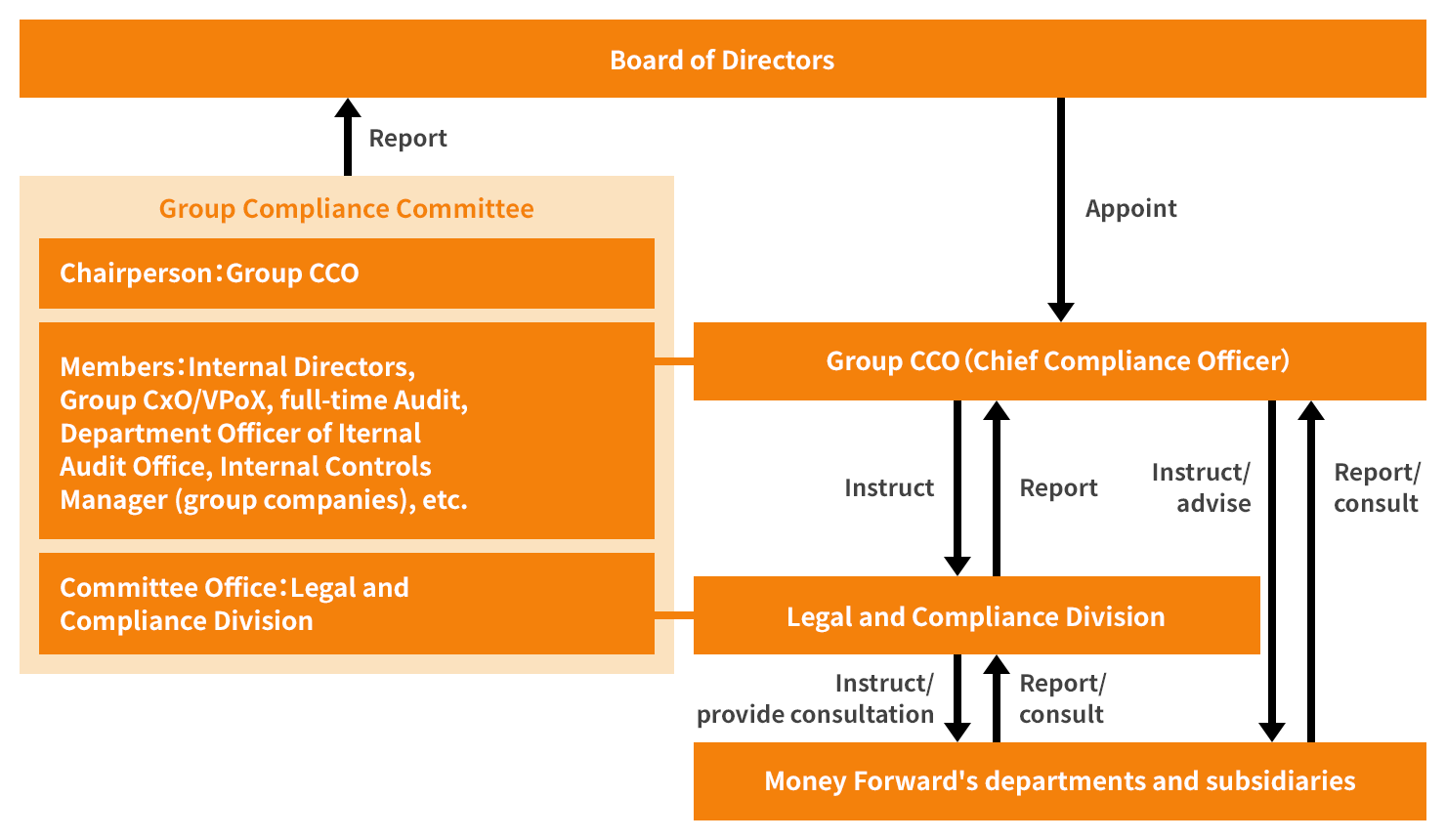

Compliance Structure

The Group Chief Compliance Officer (CCO), appointed by resolution of the Board of Directors, oversees Group-wide activities related to compliance promotion.

The Group Compliance Committee convenes once every quarter, chaired by the CCO. At the meeting, the CCO reports on the status of various initiatives for enforcing compliance practices, and also reports on and discusses matters and developments in laws and regulations that require attention in daily operations from the perspective of compliance. The committee brings together the executive team and Audit & Supervisory Board of the Company, and the representative director of each Group company, thereby establishing a structure for instilling compliance throughout the Group. In addition, the CCO promptly conveys the contents reported and discussed by the committee to the Board of Directors.

Furthermore, under the supervision of the CCO, the Legal and Compliance Division, which oversees compliance promotion activities, plays a central role in implementing compliance plans, raising and instilling compliance awareness of the Group’s officers and employees through training, etc., and responding to compliance violations.

Initiatives for Enforcing Compliance

Money Forward Group Compliance Manual

The Company has established the Group Compliance Rules that stipulates compliance control policies, systems and code of conduct and the Money Forward Group Compliance Manual that provides specific guidance on how to practice compliance for enforcing compliance and fostering compliance awareness and culture, and is working to ensure that the Rules and the Manual are shared and embraced throughout the Group.

The Money Forward Group Compliance Manual provides the basic compliance-related action guidelines that must be practiced by the Group’s officers and employees and also describes the Internal Reporting System and measures taken to address compliance violations (for example, delegation contracts may be terminated for officers, etc., and disciplinary action may be taken for employees in accordance with the work rules).

- Money Forward Group Action GuidelinesPDF(225KB)

Compliance Training

The Group provides compliance training so that all officers and employees can acquire thorough knowledge on compliance and be more aware of compliance.

Training for new employees

When joining the Group in Japan, all new officers and employees (regardless of whether they are new graduate hires, mid-career hires, part-time or casual employees, interns, temporary employees, or hired under other arrangements) attend compliance orientation using a web conferencing system with the CCO as the instructor. Participants’ understanding is encouraged through a format where the instructor not only makes one-sided explanations, but where participants answer the instructor’s questions.

In addition, they also receive training offered as e-learning programs (incorporating online learning material and comprehension tests) on the following topics: Money Forward Group Compliance Manual, information security, personal information protection, harassment prevention, and intellectual property.

Training after joining

The Group in Japan provides an e-learning program similar to the new hire compliance training but with its contents enhanced each year for all officers and employees to take once a year. The attendance rate for this training is 100%.

In addition, as training on laws, regulations, and other stipulations that officers and employees must address in daily duties, various compliance training (offered online through a web conferencing system or on-demand) focused on specific themes are conducted as needed. Manager-level programs are offered for some of these themes in an effort to offer more practical and effective educational measures.

In addition, Money Forward Vietnam Co., Ltd., our subsidiary in Vietnam, conducts compliance training for all officers and employees at the time of hire and once a year thereafter, based on local laws, regulations, and customs.

| Content | Date | Attendance rate |

|---|---|---|

| New Employee Training | Conducted throughout the year | 100% |

| Compliance, Code of Conduct | June 2024 | 100% |

| Information Security, Personal Information Protection | April 2024 | 100% |

| Intellectual Property | September 2024 | 100% |

| Harassment prevention | November 2024 | 100% |

Survey on the Group’s Compliance Initiatives

The Group has added questions on compliance to its MF Group Survey, which is a satisfaction survey conducted twice a year to objectively understand the actual status of the organization, and aims to make necessary improvements by analyzing the answers.

In the MF Group Survey conducted in the fiscal year 2024, the Group asked questions on corporate activities, management’s decisions, and harassment, as compliance-related questions. The Group’s overall score exceeded four point three out of the perfect score of five, a high score as was the case previously.

| Fiscal year 2023 | Fiscal year 2024 | |

|---|---|---|

| My manager embodies values and culture (code of conduct), and has a positive impact on members | 4.2 | 4.3 |

| The Company conducts corporate activities in accordance with compliance and ethics | 4.6 | 4.6 |

| The work environment is free of harassment (such as power harassment or sexual harassment) | 4.5 | 4.5 |

| The Company strives to preserve and improve a mentally (health-wise and free of harassment, etc.) supportive work environment | 4.3 | 4.4 |

In addition, the Group conducted a questionnaire-style survey of its officers and employees to find out whether there was any actual or potential compliance violation or harassment to identify any compliance concerns that have not yet been detected through internal reporting and to raise the compliance awareness of the Group’s officers and employees. There was a total of 26 reports such as consultations and opinions in the survey conducted in the last six months of the fiscal year 2024, and contact was made to those making the reports and coordinating with the hotline as necessary.

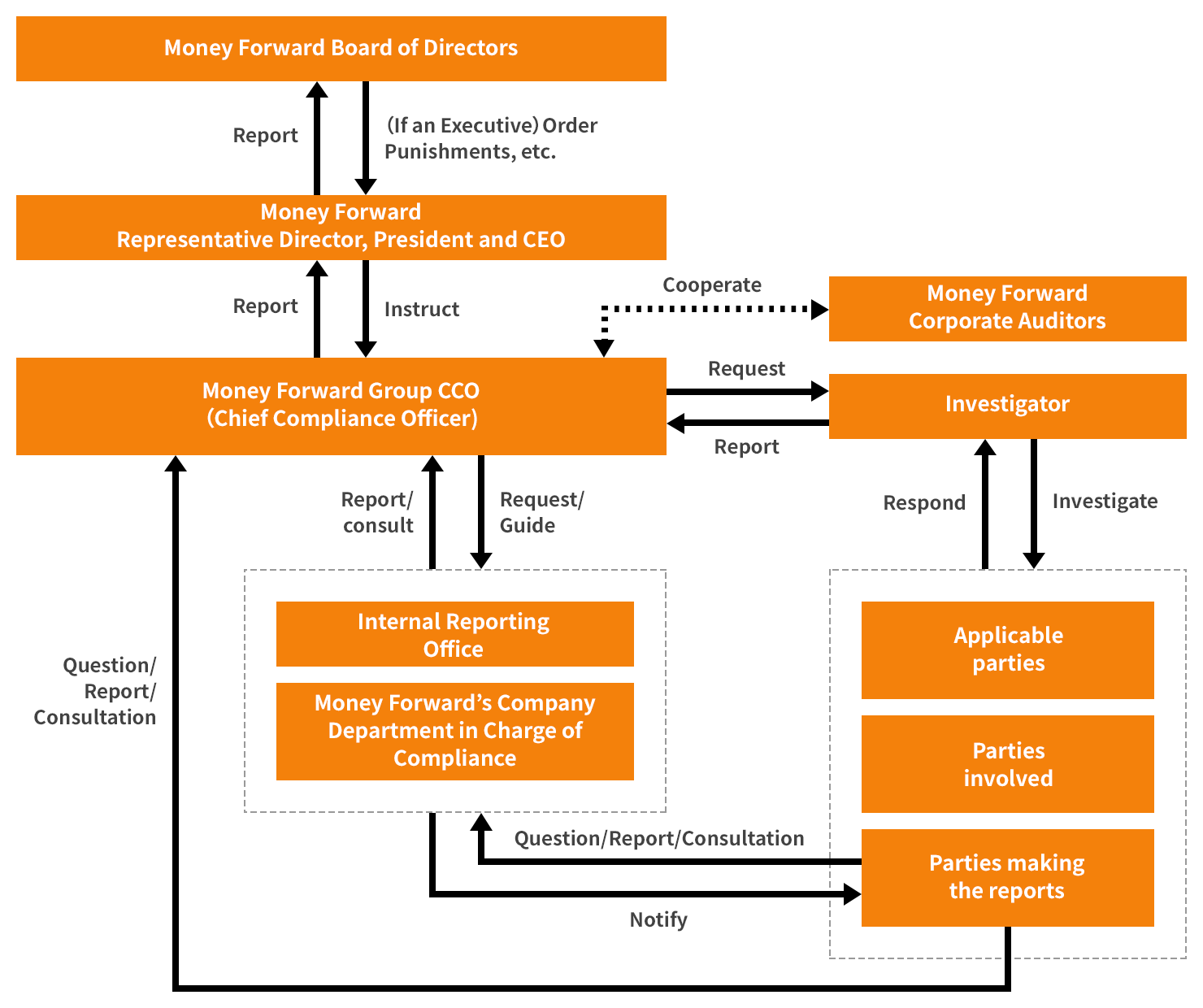

Internal Reporting System

Establishment of Hotlines

The Group has formulated the “Group’s Internal Reporting Rules” which apply to all Group companies and has established points of contact which enable the Group’s officers and employees (Officers, Group Executive Officers, employees (full-time employees, contract employees, part-time and casual employees, and interns), temporary employees, and so on, including those who currently work at the Group in addition to those who have retired from the Group within one year.) to report a violation of laws or ordinances, compliance violations (including a violation of the Group Compliance and Risk Management Rules or other internal rules or a violation of the action guidelines provided in the Money Forward Group Compliance Manual), an act of harassment, or an act that could lead to any of such violations or harassment in the Company and Group companies.

As internal reporting points of contact, in addition to the two hotlines established within the Company (harassment hotline and compliance hotline), hotlines to contact the full-time external Audit & Supervisory Board member and an outside attorney have also been established. The Group’s officers and employees can make reports by means such as email and chat tools, and reports can also be received anonymously.

For specific contact information, please refer to the Group’s internal announcements and retirement information.

Those who can use the Internal Reporting Office are officers, Executive Officers, employees (full-time employees, contract employees, part-time and casual employees, and interns), temporary employees, and so on currently working at the Group or who have retired within one year.

Whistleblower Protection

To ensure that whistleblowers are protected, the fact that reports have been made, as well as the contents of those reports, are kept strictly confidential by the parties involved in handling internal reports. Systems are in place to prevent any unfavorable treatment of whistleblowers, such as through prohibition of the identification of whistleblowers and those cooperating with investigations and the disadvantageous treatment of individuals due to whistleblowing. Furthermore, the Group follows up on reports for such purposes as confirming that whistleblowers are not being treated disadvantageously or that they are not facing other problems due to whistleblowing.

In the unlikely event of confirmation of unfavorable treatment such as breaching the confidentiality of the person who has used a point of contact, such officers and employees may be subject to severe punishment, including disciplinary action, and necessary corrective measures will be taken.

Status of System Operation

In FY11/24, the Group received 21 whistleblowing reports primarily through its hotline. Appropriate investigations are conducted for all consultations and reports, and according to the results, disciplinary action, corrective measures, and recurrence prevention measures are taken. These results are reported to the Compliance and Risk Management Committee and the Board of Directors.

To make the hotline more accessible, the Group familiarizes members with the whistleblowing system, including its strict confidentiality and the prohibition of identifying or retaliating against whistleblowers, through internal communication tools and training.

| Fiscal year 2023 | Fiscal year 2024 | |

|---|---|---|

| Sexual harassment | 4 | 0 |

| Power harassment | 12 | 14 |

| Other harassment | 0 | 0 |

| Labor management | 0 | 0 |

| Violation of internal rules or other rules | 0 | 0 |

| Other | 1 | 7 |

*The total number does not match the total number of consultations and reports as there were cases where two or more of the classifications were applicable for one case

Activities to Prevent Bribery

For the Group to prevent bribery of public officials, etc. and build appropriate and highly transparent relationships free of corruption with users and business partners, the Company’s Board of Directors has formulated and disclosed the “Group Basic Policy on Prevention of Bribery.”

Based on this Policy, the Company and Group companies have established the “Group Basic Rules on Prevention of Bribery,” which stipulate the code of conduct and other specific rules that must be observed covering the matters listed below. The Group ensures that all officers and employees are fully aware of the Basic Rules.

(1) Prohibition of bribery of public officials, etc.; procedures to be followed for approval of exceptional cases in which benefits are provided within the scope of common sense and not in violation of laws and other regulations; duty to report instances in which public officials, etc. make demands for acts that are suspected to constitute the provision of money or other benefits or other such acts.

(2) Observance of rules on orders and procurement when hiring agents, etc.; the addition of a bribery prevention clause if there is risk of bribery in light of the content of related transactions.

(3) Prohibition of the provision of money or other benefits to, and receipt of money or other benefits from, third parties other than public officials, etc. for the purpose of securing benefits for oneself or third parties; prohibition of the provision, etc. of money or other benefits that exceed the scope of common sense to third parties other than public officials, etc.

(4) Performance of appropriate due diligence of the target company when conducting corporate reorganization (such as a merger, company split, share exchange, or share transfer), or when taking over a different company’s business.

To raise the effectiveness of activities to prevent bribery, the Group thoroughly informs all officers and employees of the above matters using internal bulletin boards and communication tools and educates them through training, while also establishing internal reporting points of contact that accept anonymous reports and ensuring awareness of the Internal Reporting System, which includes whistleblower protection.

If a violation or an act that could lead to any violation of the “Group Basic Rules on Prevention of Bribery” or relevant rules, etc., is discovered, an investigation will be conducted, and full cooperation will be given to any investigations by relevant authorities, etc.

Furthermore, in the fiscal year ended November 30, 2024, there were no cases of legal action such as fines or penalties for bribery, etc., and no cases of monetary settlements.

Additionally, there were no political contributions made by our company group.

Activities to Eliminate Anti-Social Forces

The Group rejects relationships with anti-social forces, and there is no evidence that the Group is currently involved with any anti-social forces.

The Company has formulated and disclosed its “Basic Policy on Prevention of Damage from Anti-Social Forces” as a basic principle for blocking and eliminating relationships with anti-social forces. Based on this Policy, the Company has established the “Group Rules for Responding to Anti-Social Forces,” and a division in charge of responding to anti-social forces continuously checks the latest information on laws, regulations, guidelines, and norms aimed at eliminating anti-social forces, and has been striving to build a system for eliminating anti-social forces and making this system known to officers and employees by attending seminars organized by specialized organizations and collecting information. In addition, in order to prevent damage caused by unreasonable demands from anti-social forces, learn countermeasures, and collect information, the Company has appointed a person responsible for preventing unreasonable demands and notified the relevant police station.

The Company conducts investigations regarding anti-social forces when entering into new transactions and also conducts periodic investigations of existing business partners. The Company also conducts investigations when newspapers and other media report suspicions of anti-social forces or transactions with anti-social forces. In addition, the Company periodically conducts investigations of its shareholders, officers, and employees regarding anti-social forces by the same method, with the scope of investigation defined for each.

Furthermore, when concluding contracts with business partners, the Company stipulates in contracts elimination clauses that stipulate immediate termination of transactions, etc., if the parties are found to be anti-social forces.

In the case where unreasonable demands are made by anti-social forces, the Company as a whole will respond to the situation, and commit to responding resolutely, while cooperating with external professional parties including lawyers, the relevant police station, the Special Violence Prevention Countermeasure Federation (Tokubouren) and the Tokyo Center for Removal of Criminal Organizations.