INDEX

Basic Policy on Corporate Governance

The Company endeavors to steadily increase shareholder value on a long-term basis, based on the recognition that it is essential for corporate governance to function effectively in order to pursue sustainable enhancement of corporate value in the IT industry, where the operating environment is subject to constant change.

In addition to respecting all stakeholders and raising corporate soundness and transparency, with an aim to achieve a steady increase in shareholder value on a long-term basis, the Company strives to develop an internal structure which allows for prompt and rational decision-making as well as streamlined business execution, and to thereby solidify its corporate governance.

Corporate Governance Report (English)PDF(905KB)

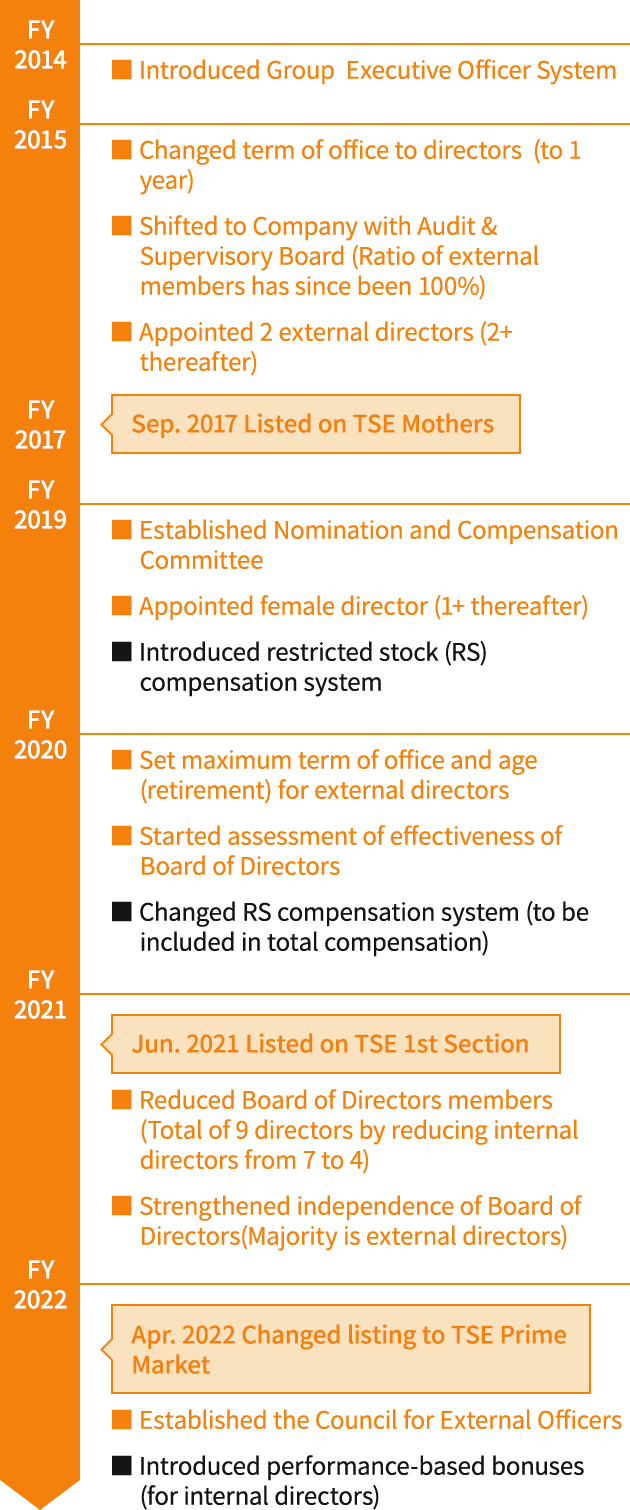

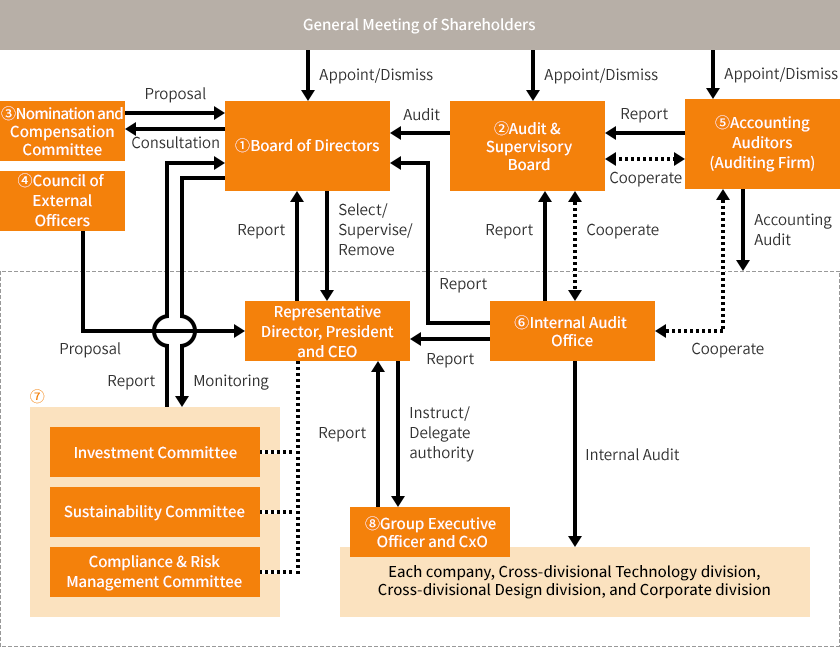

Transition of Corporate Governance Enhancement

The Company considers the development and strengthening of its corporate governance system to be one of its highest management priorities, and is implementing ongoing initiatives to this end.

Overview of Corporate Governance Structure

The Company, which offers a platform service as its core business, has adopted an Corporate Auditors system. This is to ensure managerial efficiency and soundness, it is effective to have in place a structure where the Board of Directors, consisting of directors who are familiar with the Company’s business, decides on basic management policies and important business execution, while Corporate Auditor, with strong legal authority, audit the directors’ execution of duties from an independent position.

The Company has strengthened the supervisory function of its Board of Directors by appointing independent external directors as the majority for the board. It has also set up the Nomination and Compensation Committee, in which external directors comprise the majority, and the Council of External Directors and Auditors, which consists solely of external officers (external directors and external Corporate Auditor).

| Organizational Form | Company with Board of Corporate Auditors | |

|---|---|---|

| Chairperson of the Board of Directors | Yosuke Tsuji | |

| Directors | Members | 11 (among whom 2 is female, and among whom 1 director is of a foreign nationality) |

| % of External Members | 54.5%(6 persons. among whom 5 have experience of managing other companies.) | |

| Board of Directors Meetings(Year Ending November 2024) | No. of Meetings | 13 |

| Attendance Rate | 100% for 13 members and 92.9% for one member | |

| Corporate Auditor | Members | 3(All are independent external Corporate Auditor with knowledge and experience in finance and accounting, with 1 also having knowledge and experience in legal affairs) |

| % of External Members | 100%(3persons all of them.) | |

| Audit & Supervisory Board Meetings (Year Ending November 2024) | No. of Meetings | 16 |

| Attendance Rate | 100% | |

| Committee | Nomination and Compensation Committee、Investment Committee、Sustainability Committee、Compliance and Risk Management Committee | |

| Executive Officers | 24 (among whom 3 are females) | |

| Group CxO・VPoX | CEO、CTO、CISO、CFO、CSO、CIO、CDO(Chief Design Officer)、CoPA (Chief of Public Affairs)、CLO(Chief Legal Officer)、CCO(Chief Compliance Officer)、CHO(Chief Human Officer)、VPoC(Vice President of Culture)、VPoE(Vice President of Engineer) | |

| Accounting Auditors | Deloitte Touche Tohmatsu LLC | |

①Board of Directors

The Company currently has eleven directors. Independent external directors are to comprise a majority of the Board of Directors, and accordingly, six among the eleven are independent external directors.

In addition to the requirements of independent officers set forth in the Companies Act and by the Financial Instruments and Exchange, the Company has stipulated independence criteria for appointing independent external directors. The Company appoints external directors in accordance with these standards, with all six external directors being registered as independent directors.

The Company has set up a Nomination and Compensation Committee, in which the majority consists of external directors. The aim of the committee is to strengthen the objectivity and accountability of the Board of Directors, and to reinforce the Group’s corporate governance structure. All director candidates are subject to deliberations by the committee and resolution by the Board of Directors.

Furthermore, the term of office for Directors is one year, with an aim to clarify Directors’ managerial responsibilities and develop a management structure that can respond promptly to changes in the business environment.

Current Operations of the Board of Directors

The Company’s Board of Directors is chaired by Yosuke Tsuji, Representative Director, President and Group CEO. In addition to monthly meetings (normally two hours; three hours or longer for four meetings a year)), extraordinary meetings are held as necessary to make critical managerial decisions and supervise the execution of duties by each director.

The Company has stipulated the regulations of the Board of Directors, under which the Board of Directors deliberates and resolves 1) matters stipulated in laws and ordinances and the Articles of Incorporation, 2) important matters regarding management in general, including management policies and plans, 3) basic matters regarding the Company’s management, including key organizational and personnel agenda, and 4) important matters regarding business execution, including highly significant investments and loans to Group companies. As to critical managerial issues, and matters requiring a medium- to long-term outlook, the Board of Directors holds discussions on the assumption that a resolution need not be reached during the meeting in which the agenda was raised. In addition, for matters to be resolved and reported that are able be determined through documents alone, the Board of Directors may omit resolutions and reports using the method of email, thereby ensuring that the Board of Directors has sufficient time for deliberations.

Key matters deliberated or discussed, and Key contents reported for the Fiscal Year ending November 2024 are as follows.

| Key Matters Deliberated or Discussed | Budget and medium-term management plan, financial results, capital allocation (including setting an upper limit for investment by Investment Committee), fund procurement, new businesses, various investment projects (including capital and business tie-ups), whether to continue holding cross-shareholdings, reorganization within the Group, Group management strategies, personnel affairs, evaluation, and compensation regarding officers (including the incentive system), composition of the Board of Directors, audit plan, internal audit structure, D&O insurance, statutory disclosure, timely disclosure |

|---|---|

| Key Contents Reported | Financial results and KPIs (including reports on financial results of Group Companies), comparison with competition, personnel affairs (including D&I activities), IR and SR activities, matters discussed by the Nomination and Compensation Committee, sustainability activities, compliance and risk management, implementation status of internal control system, information security, public affairs activities, results of exercise of voting rights at general meeting of shareholders, evaluation of the effectiveness of the Board of Directors, internal audit results |

Analysis and Evaluation of the Effectiveness of the Board

The Company commissions an external third-party institution to annually analyze and evaluate the effectiveness of the Board of Directors, with the goal of improving its functionality and achieving sustainable corporate growth and medium to long-term corporate value.

■Initiatives to Improve Effectiveness Based on Last Year’s Evaluations

- ・The following initiatives were conducted so the Board of Directors had sufficient time to discuss medium- to long-term strategies and issues, etc. to be discussed.

- ・Resolutions, etc. using only email for content that can be understood and where the validity can be determined through text alone, such as revisions of internal rules.

- ・Restrict the number of proposals the Board of Directors has to deal with through transferring authority to executive members.

- ・Matters discussed and identified by the Council of External Directors and Auditors to be on the agenda for the Board of Directors.

- ・Send a complete set of Board of Directors materials before meetings (in principle, one week before, and three business days before fiscal year ending meetings to shorten oral explanations and to increase time for questions and answers and discussions.

■Year Ending November 2024Evaluation Methods

The Company conducted a survey (listing a score out of five and comments) of all Directors and Corporate Auditor asking them 28 questions on the following topics.

(1) Composition and operation of the Board of Directors (two questions)

(2) Operation and information provision of the Board of Directors (eight questions)

(3) Supervision and confirmation of strategies by the Board of Directors (six questions)

(4) Risk management (four questions)

(5) Monitoring of corporate ethics and performance (two questions)

(6) Evaluation and compensation of top management (four questions)

(7) Dialogues with institutional investors (two questions)

Year Ending November 2024 Evaluation Process

December 2024: Consideration of policy to implement effectiveness evaluation

December 2024 to January 2025: Conduct survey of Directors and Corporate Auditor (acquire results from all parties)

February 2025: Share results of survey to the Board of Directors

March 2025 to April (scheduled): Board of Directors to discuss future initiatives based on results of the survey

■Overview of FY Year Ending November 2024 Analysis and Evaluation Results

- ・As in the previous fiscal year, the average score of all evaluation items was high, indicating that the respondents considered that the Board generally ensured its effectiveness. The discrepancies between the evaluations of Directors and Corporate Auditor and between Internal and External Officers were generally small, with no significant bias.

- ・In the evaluation of the effectiveness of the Board of Directors held in the previous fiscal year, the items (2) Operation and information provision of the Board of Directors and (3) Supervision and confirmation of strategies by the Board of Directors were the two items with low scores among all items, but as a result of the above initiatives, the score of (2) rose 0.19 and that of (3) increased by 0.18, reflecting the impact of the measures.

- ・The major item that received the highest score was (7) Dialogues with institutional investors. The Company has been holding repeated discussions at the Board of Directors meetings to form a common perspective in order to appropriately reflect the feedback from constructive dialogues with foreign institutional investors in management. This initiative was evaluated as an important factor in earning the trust of foreign institutional investors.

- ・Furthermore, as in the previous fiscal year, the score for (1) Composition of the Board of Directors was high, and responders expressed views including the following: The composition of the Board of Directors, made up of External Directors with abundant experience in various fields and Directors well-versed in the situation of internal departments, is highly comprehensive and outstanding.

- ・Of the individual items, “appropriate progress of meetings” and “role and function of Nomination and Compensation Committee related to nomination and compensation” received high scores and were rated as factors clearly indicating that the Company’s corporate governance structure is functioning effectively and has reached a high level.

- ・The items that received relatively low scores were “corporate value improvement through actions addressing sustainability-related issues” and “oversight of development of management personnel,” which were assessed as having room for improvement.

②Board of Corporate Auditors

All three Corporate Auditors are independent external members, including one lawyer. In addition to the requirements of independent officers set forth in the Companies Act and by the Financial Instruments and Exchange, the Company has stipulated independence criteria for appointing external Audit and Supervisory Board members. The Company appoints external members in accordance with these standards, with all three external members being registered as independent officers.

The Corporate Auditor is chaired by a full-time Corporate Auditor, and holds monthly meetings as well as extraordinary meetings on an as-needed basis (approximately one hour).

Main Topics Shared and Discussed for the Fiscal Year Ending November 2024

Basic policy, priority audit policy, division of roles of each Corporate Auditor, appropriateness of audits by Accounting Auditors, audit results related to internal control systems, and status of operation of internal controls of the corporate group

③Nomination and Compensation Committee

The Company has established the Nomination and Compensation Committee as a voluntary body in order to strengthen the independence, objectivity, and accountability of the Board of Directors’ functions and to further enhance the Group’s corporate governance system by ensuring the transparency and objectivity of the nomination of Directors and the evaluation and decision-making processes related to compensation, etc. for Directors and Executive Officers.

The Nomination and Compensation Committee makes reports in response to an inquiry regarding the composition of the Board of Directors, the appointment and dismissal of Directors, the appointment and dismissal of the Representative Director, the composition and level of compensation for Directors, and a draft concerning limits on the total amount of compensation for Directors and Corporate Auditor, etc. The Nomination and Compensation Committee also determines the compensation of individual Directors, as delegated by the Board of Directors.

The Nomination and Compensation Committee consists of at least three Directors appointed by a resolution of the Board of Directors, and External Directors shall comprise the majority of the Nomination and Compensation Committee.

Members

The committee for the Fiscal Year ending November 2025 is comprised of the following three members who were selected by resolution of the Board of Directors.

Chair : Yosuke Tsuji, Representative Director and President

Members : Masaaki Tanaka (Independent External Director), Gen Miyazawa (Independent External Director), Ryu Kawano Suliawan(Independent External Director)

Main Topics of Discussion for the Fiscal Year Ening November 2024

Policy on the composition of the Board of Directors, policy on appointment and dismissal of Directors, nomination of candidates for Directors, policy on the determination of compensation, etc. for Directors (composition and level of compensation for Directors), amount of compensation, etc. for individual Directors, and limit on the total amount of compensation for Directors and Corporate Auditor.

④Council of External Directors and Auditors

The Company has established the Council of External Directors and Auditors consisting of all External Directors and External Corporate Auditors in order to improve the monitoring of executive departments and to contribute to the Company’s sustainable growth and medium- to long-term corporate value enhancement by having External Officers (External Directors and External Corporate Auditors), who play a role in corporate governance, work together and exchange opinions on a regular basis. The meeting of the Council of External Directors and Auditors is held once every three months as a principle to discuss and exchange opinions on matters including significant managerial issues, corporate governance, and risks regarding management and business performance and action plans for such risks. The content of discussions at the council meeting is shared by its chair Masaaki Tanaka with the Company’s Representative Director, President, and Group CEO, Yosuke Tsuji, and recommendations are made to the executive departments, as necessary.

Main Topics of Discussion for the Fiscal Year Ending November 2024

Medium- to long-term methods to approach management discussions, portfolios for business, governance (organizational planning), human resources compensation system, and decisions aimed at enhancing corporate value

Main points of feedback for Year Ending November 2024

- ・We should clearly explain the direction of the Company in the medium to long term of five years and 10 years from now, how to secure financial and other resources for achieving it, and how the Company will allocate these resources.

- ・We should strengthen to some extent the function of financial planning, which is slightly different from management planning.

- ・Currently the Group has both centripetal force and centrifugal force in play, but we should also reinforce the structures of overall business management, audit, etc.

⑤Accounting Auditors

The Company has concluded an auditing agreement with Deloitte Touche Tohmatsu LLC, and audits are performed in a timely and appropriate manner.

⑥Internal Audit Office

The Company has established a dedicated Internal Audit Office, and the Office is responsible for conducting internal audits and evaluating internal controls.

The Internal Audit Office prepares internal audit plans based on the Internal Audit Rules established by the Company, and subject approval by the Representative Director, President and Group CEO, audits all Divisions and Offices of the Company and all Group Companies. The result of the audit is reported to the Representative Director, President and Group CEO, and the Board of Corporate Auditors.

The Internal Audit Office conducts internal audit under the basic policy of investigating the status of the Company’s business operation and property management; confirming compliance with the management policy, laws and regulations, Articles of Incorporation, and various rules; and aims to secure preservation of company property and appropriateness of business operation, to contribute to streamlining management and improving efficiency.

While the Internal Audit Office conducts audit independently from the Corporate AuditorsMember and Accounting Auditors, information is regularly exchanged to share information necessary for audits and to improve efficiency through mutual cooperation.

⑦Committees

The Company aims to maintain a compliance structure for deploying business management grounded in sound ethical standards, secure corporate soundness and transparency, and firmly increase long-term shareholder value. To achieve this end, the Company is building an internal structure that drives prompt and rational decision-making as well as efficient business execution. In this vein, it has set up three committees under the Board of Directors (focused on sustainability, investment, and compliance and risk management).

The Representative Director, President and Group CEO chairs all committees, and regularly reports the status of activities of each committee to the Board of Directors.

⑧Executive Officer System, Group Chief Officer System, and VpoX System

The Company has adopted an Executive Officer System since October 2014.

The Company aims to expedite the decision-making process and clarify the responsibilities and authorities of business execution by separating the business execution functions from the management decision-making and business supervision functions of Directors. Executive Officers are responsible for business execution including decision-making pertaining to their duties, and promptly execute business based on the management decision-making by implementing the matters determined by the Board of Directors.

The Company adopts a Chief Officer System ・VpoX to further clarify the separation of supervision and execution functions to enable agile business execution.

*Please see the career summaries of Executive Officers and Executive Officers here.

Officers

Policy on the composition of the Board of Directors. The Company has established the following policy on the composition of the Board of Directors by a resolution of the Board of Directors after deliberation by the voluntary Nomination and Compensation Committee.

- ・The number of members of the Board of Directors shall be determined in accordance with the Company’s Articles of Incorporation and shall be considered appropriate for the purpose of stimulating deliberations and ensuring accurate and prompt decision-making.

- ・The number of Independent External Directors shall be large enough such that Independent External Directors comprise the majority of the Board of Directors.

- ・To ensure the independence of External Directors, the total term of office of Independent External Directors shall be six terms (six years), and reappointment shall not be prevented for up to eight terms (eight years). In cases where a Director is aged 72 by the end of an Annual General Meeting of Shareholders, the Director shall resign as of the end of that meeting.

- ・In order to effectively fulfill the roles and responsibilities of the Board of Directors, the Board of Directors shall be composed of individuals with knowledge, experience, and abilities in “corporate management,” “global business,” “business and industry understanding (SaaS and Fintech),” “investment and M&A,” “finance and accounting,” “human resources development,” “legal compliance and risk management,” “technology,” “sustainability and ESG,” and shall also be composed of diverse Officers with regard to gender, internationality, age, and other factors.

- ・Independent External Directors shall include those with management experience at other companies.

| Name | Age | Gender | Position and title | Tenure | |

|---|---|---|---|---|---|

| Directors | Yosuke Tsuji | 48 | Male | Representative Director, President and CEO Nomination and Compensation Committee | 12 years and 3 months |

| Naoya Kanesaka | 40 | Male | Director, Group Executive Officer and CFO | 8 years | |

| Takuya Nakade | 47 | Male | Director, Group Executive Officer and CTO | 7 years | |

| Masanobu Takeda | 48 | Male | Director, Group Executive Officer and Money Forward Business Company COO | 6 years | |

| Chiaki Ishihara | 37 | Female | Director, Group Executive Officer and CHO | – | |

| Masaaki Tanaka | 71 | Male | Independent External Director Nomination and Compensation Committee | 7 years | |

| Akira Kurabayashi | 50 | Male | Independent External Director | 7 years | |

| Hiroaki Yasutake | 53 | Male | Independent External Director | 3 years | |

| Gen Miyazawa | 43 | Male | Independent External Director Nomination and Compensation Committee | 3 years | |

| Ryu Kawano Suliawan | 41 | Male | Independent External Director Nomination and Compensation Committee | 1 year | |

| Yukino Kikuma | 52 | Female | Independent External Director | 1 year | |

| Corporate Auditor | Masami Hatakeyama | 63 | Male | Independent External Corporate Auditors (full-time) | 2 years |

| Katsuyuki Tanaka | 60 | Male | Independent External Director | 7 years | |

| Hidetoshi Uriu | 49 | Male | Independent External Director | 7 years |

*Age, position and title, and tenure are those as of February 28, 2025

*Please see the career summaries of Officers here.

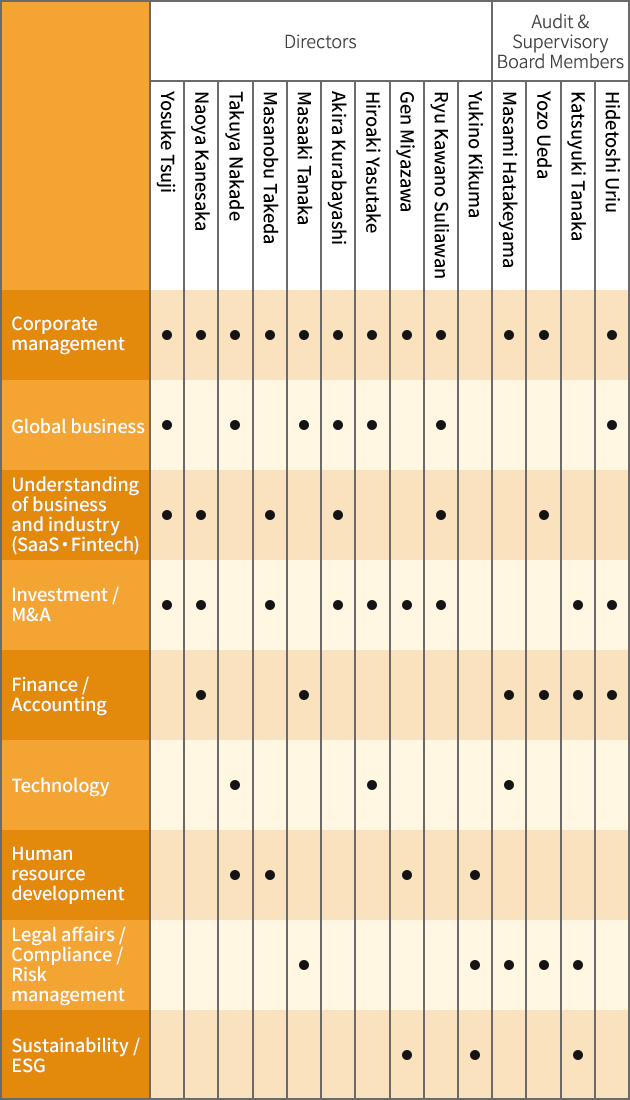

Skill Matrix

Set forth below is a skill matrix for Director and Corporate Auditors.

This table does not represent all the skills possessed by the Directors and Corporate Auditors. For each officer, it maps four fields in which the Company expects each of them to contribute to discussion at the Board of Directors meetings, in light of each of their specific knowledge, experience, etc.

| Skill | Definition | Reason for selection |

|---|---|---|

| Corporate management | Experience as a Representative Director or as a Director of a listed company. | Management experience is required for sustained growth and development during changes in the business environment. |

| Global business | An overseas posting or knowledge, experience and skill in supporting and managing an overseas business. | The Company has established overseas offices and invests in overseas companies, thus this skill is required to formulate the future growth strategy and execute appropriate management supervision. |

| Understanding of business and industry (SaaS Fintech) | Knowledge and experience of the SaaS and Fintech industries. | The Company manages businesses in the SaaS and Fintech field, so this skill is required to formulate a sustained growth strategy and understand the business environment. |

| Investment/ M&A | Knowledge, experience and skills in investment and M&A. | The Company has enjoyed non-organic growth due to Knowledge, experience and skills in M&A and investment activities. This skill is required for investment and M&A. sound investment activities without a drop in the pace of future growth. |

| Finance/ Accounting | Knowledge, experience and skills in finance and accounting. | Together with undertaking accurate financial reporting, the Company needs to continuously undertake investment Knowledge, experience and skills in activities (not limited to investment in M&A and business finance and accounting. companies, but including investment in existing businesses) to build a solid financial base and for future sustained growth, thus how and when to procure funds for such purpose are important. |

| Technology | Knowledge, experience, and skills in technology. | The speed of innovation and change in customer needs in Knowledge, experience, and skills in internet-related markets is rapid, thus the Company continuously needs to understand and respond to the latest technological trends and changes in the environment. |

| Human resources development | Knowledge, experience, and skills in human resources development. | To realize its Mission and Vision, the Company has focused on the development of its business and organization, together with the growth of its members. The Company believes that talent development is critical. |

| Legal affairs/ Compliance/ Risk management | Knowledge, experience and skills in legal affairs, compliance, and risk management. | In order to pursue sustainable enhancement of corporate value in the IT industry, where the operating environment is subject to constant change, the Company needs to implement a compliance structure based on sound ethics. The Company also requires appropriate risk management for sound growth. |

| Sustainability/ ESG | Knowledge, experience, and skills on non-financial matters that support corporate sustainability such as the environment, social and governance issues. | The Company aims to realize a society that is sustainable for individuals and businesses and to steadily increase corporate value by facing the universal and expansive financial issues and eliminating financial issues and concerns from the world. |

Officer Compensation

Director Compensation

The annual upper limit of directors’ compensation has been set to 500 million yen by resolution of the General Meeting of Shareholders. Furthermore, a restricted stock compensation scheme has been introduced, with the total amount of monetary compensation receivables for granting restricted stocks to eligible directors set to 200 million yen or less per year (Among which 20 million yen or less for External Directors. However, this does not include employee salaries for Directors concurrently serving as employees.) within the annual upper limit of 500 million yen, with the total amount of restricted stock to be allotted to be a maximum of 148,000 shares (among which 14,800 shares for External Directors) by resolution of the General Meeting of Shareholders.

500 million yen or less | |||

200 million yen or less | |||

| Base Compensation | Variable Compensation | Stock Compensation | |

|---|---|---|---|

| Fixed monetary compensation according to one’s responsibilities to encourage the execution of duties in addition to sufficient managerial supervision functions | Variable compensation as a short-term incentive to firmly achieve corporate performance targets for each fiscal year | A restricted stock compensation system positioned as a medium- to long-term incentive to increase corporate value by sharing value with shareholders and raising awareness of stock prices among directors | |

| Internal Directors | ○ | ○ | ○ |

| External Directors | ○ | ○ | |

Further, at the 13th Annual General Meeting of Shareholders held on February 25, 2025, the Company decided to grant stock compensation-type stock options in addition to or in place of restricted stock compensation. However, the upper limit of the sum of the total compensation from stock acquisition rights as stock compensation-type stock options issued during the same business year and the total compensation from restricted stock compensation shall be 200 million yen per year (including up to 20 million yen for External Directors; however, it does not include employee wages for Directors who also serve as employees), and the upper limit of the sum of the total number of shares of the Company’s common stock issued upon exercise of stock acquisition rights as stock compensation-type stock options issued during the same business year and the total of restricted stock shall be 148,000 shares (of which, 14,800 shares for External Directors).

We have introduced clawback and malus provisions as part of our executive compensation framework starting February 25, 2025, with the aim of ensuring greater transparency and sound governance. These provisions apply to a portion of the compensation for executive directors. In the event of material accounting errors, fraud, or any other reasons as determined by the Board of Directors, the Nomination and Compensation Committee, an advisory body to the Board, will review the individuals subject to the provisions, the applicable compensation, and the amount to be reclaimed or forfeited. Based on the committee’s recommendations, the Board will make a final resolution. These provisions will apply to compensation for the Fiscal Year ending November 2025 and beyond.

Decision-Making Process on Compensation

The Nomination and Compensation Committee, a voluntary body of the Board of Directors, deliberates on the compensation of Directors within the limit resolved at the General Meeting of Shareholders and the composition, level, and maximum amount of pool of Directors’ compensation are determined by the Board of Directors based on the Committee’s proposal. The composition and level of Directors’ compensation are set to levels that appropriately compensate for the sufficient execution of the Company’s managerial decision making and supervisory functions, taking into account social and market conditions and comparing with other companies.

Individual compensations are determined by the Nomination and Compensation Committee, entrusted by the Board of Directors, as delegated by resolution of the Board of Directors, based on the composition, level, maximum pool, etc., determined by the Board of Directors, taking into account responsibilities achievements, etc. expected to be fulfilled by each Director (including abilities and results for the Representative Director and Executive Directors), and based on a Directors’ compensation chart according to the title.

Within monetary compensation, with regard to short-term variable compensation, the Nomination and Compensation Committee deliberates and decides on the specifics after each director performs a self-evaluation on the achievement of one’s goals. As for the compensation of the representative director, deliberations and decisions are made by members of the Nomination and Compensation Committee excluding the representative director, while taking into account the opinions of external directors as needed. Furthermore, because the majority of both the Board of Directors and the Nomination and Compensation Committee is composed of independent external directors, no resolutions are made only by internal directors in order to secure transparency and objectivity for the evaluation and determination process concerning the compensation, etc.

Corporate Auditors Compensation

Compensation of Corporate Auditors has been set to no more than 50million yen per year by resolution of the General Meeting of Shareholders. It is composed solely of a base compensation in the form of a fixed monetary compensation in accordance with one’s responsibilities, so that members will sufficiently fulfill auditing and managerial supervision functions and execute their duties. Compensation of individual Corporate Auditors shall be determined upon discussion by the Board of Corporate Auditors within the upper limit resolved at the General Meeting of Shareholders.

Amount of Officer Compensation, etc. for the Fiscal Year Ending November 2024

Total amount of Director Compensation and Corporate Auditors Compensation for the fiscal year ending November 2024 is as follow.

The figure for variable compensation is the amount booked as a provision before taking into account performance evaluation for year ending November 2024, and variable compensation for year ending November 2024 is stated as the difference resulting from the calculation taking into account performance evaluation. The actual amounts paid are calculated and determined based on individual Directors’ performance evaluations, etc. Furthermore, for the one Director who does not reside domestically, in lieu of restricted stock compensation, share price-linked monetary compensation (phantom stock) was paid within the compensation limits, and stated is the amount recorded as expenses for the current fiscal year.

The table blow includes values associated to one director who resigned as of the end of the twelvesAnnual General Meeting of Shareholders held on February 28, 2024.

| Title | Total Compensation, etc. (¥mn) | Breakdown by Compensation Type (¥mn) | No. of Eligible Officers | ||

|---|---|---|---|---|---|

| Base | Variable | Non- Monetary, etc. | |||

| Directors (External Members) | 269 (62) | 120 (45) | 54 (0) | 94 (15) | 11 (7) |

| Audit & Supervisory Board Members (External Members) | 45 (45) | 45 (45) | – | – | 4 (4) |

| Total (External Members) | 314 (107) | 165 (90) | 54 (0) | 94 (15) | 15 (11) |